What are banking systems and their functions?

Banking systems refer to the infrastructure, processes, and technologies that enable financial institutions to offer a range of services to their customers. These systems play a crucial role in the functioning of the banking industry and support various functions and operations. Here are some key functions of banking systems:

1. Account Management: Banking systems facilitate the creation and management of customer accounts, including savings accounts, current accounts, and fixed deposit accounts. They handle account opening, maintenance, transaction processing, and balance management.

2. Payment Processing: Banking systems enable the processing of various types of payments, such as fund transfers, bill payments, online transactions, and direct debits. They ensure the secure and efficient transfer of funds between accounts and across different financial institutions.

3. Loan and Credit Management: Banking systems support the management of loans and credit products. They handle loan application processing, credit evaluation, approval, disbursement, and repayment tracking. These systems also manage credit card operations, including transactions, billing, and statement generation.

4. Risk Management: Banking systems incorporate risk management features to assess and manage risks associated with financial activities. They analyze credit risks, monitor fraud, detect suspicious activities, and implement measures to mitigate risks and ensure regulatory compliance.

5. Customer Relationship Management (CRM): Banking systems often include CRM functionalities to manage customer relationships. They store customer information, track interactions, and provide personalized services based on customer preferences and profiles.

6. Financial Reporting: Banking systems generate financial reports, including balance sheets, income statements, and cash flow statements. These reports provide insights into the financial health and performance of the bank and support regulatory compliance.

7. Security and Fraud Prevention: Banking systems employ security measures to protect customer data, prevent unauthorized access, and detect and prevent fraudulent activities. They implement encryption, authentication mechanisms, and monitoring tools to ensure the security of transactions and customer information.

8. Integration with External Systems: Banking systems integrate with external systems such as payment networks, regulatory bodies, credit bureaus, and other financial institutions. This integration enables seamless interoperability, data exchange, and compliance with industry standards.

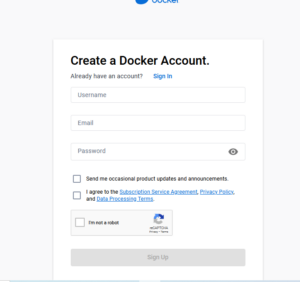

9. Digital Banking and Self-Service: Modern banking systems support digital banking channels, including online banking portals, mobile applications, and self-service kiosks. These platforms enable customers to access banking services, perform transactions, check balances, and manage accounts conveniently.

10. Regulatory Compliance: Banking systems incorporate features to ensure compliance with financial regulations, anti-money laundering (AML) laws, know-your-customer (KYC) requirements, and data protection regulations. They maintain audit trails, generate compliance reports, and implement necessary controls.

Overall, banking systems are complex software solutions that support the wide range of functions and operations required by financial institutions. They play a critical role in ensuring efficient and secure banking services, enhancing customer experience, and maintaining the integrity and stability of the financial system.